Fast invoice funding with APositive

Invoice, fund, and pay in a few easy clicks and boost your cash flow confidence.

An instant invoice funding solution, purpose-built for labour hire

Invoice financing gives you access to cash exactly when you need it, so you can take on bigger jobs and grow.

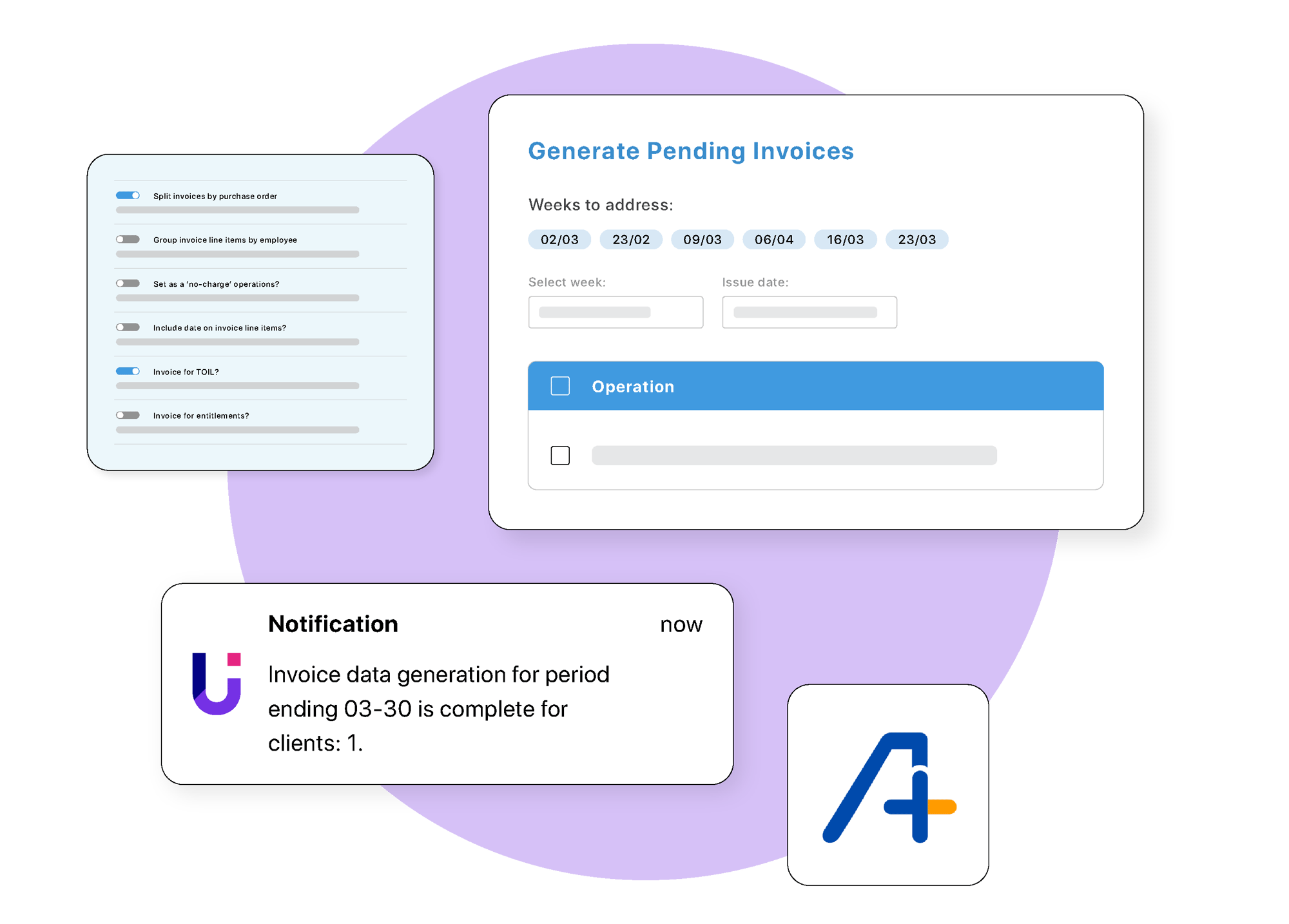

Create accurate invoices fast

Use your payroll data to create invoices that factor in your wage costs and charge rates.

Get funding in matter of clicks

Automatically send your invoice to APositive and access up to 90% of your invoice funds, often within minutes.

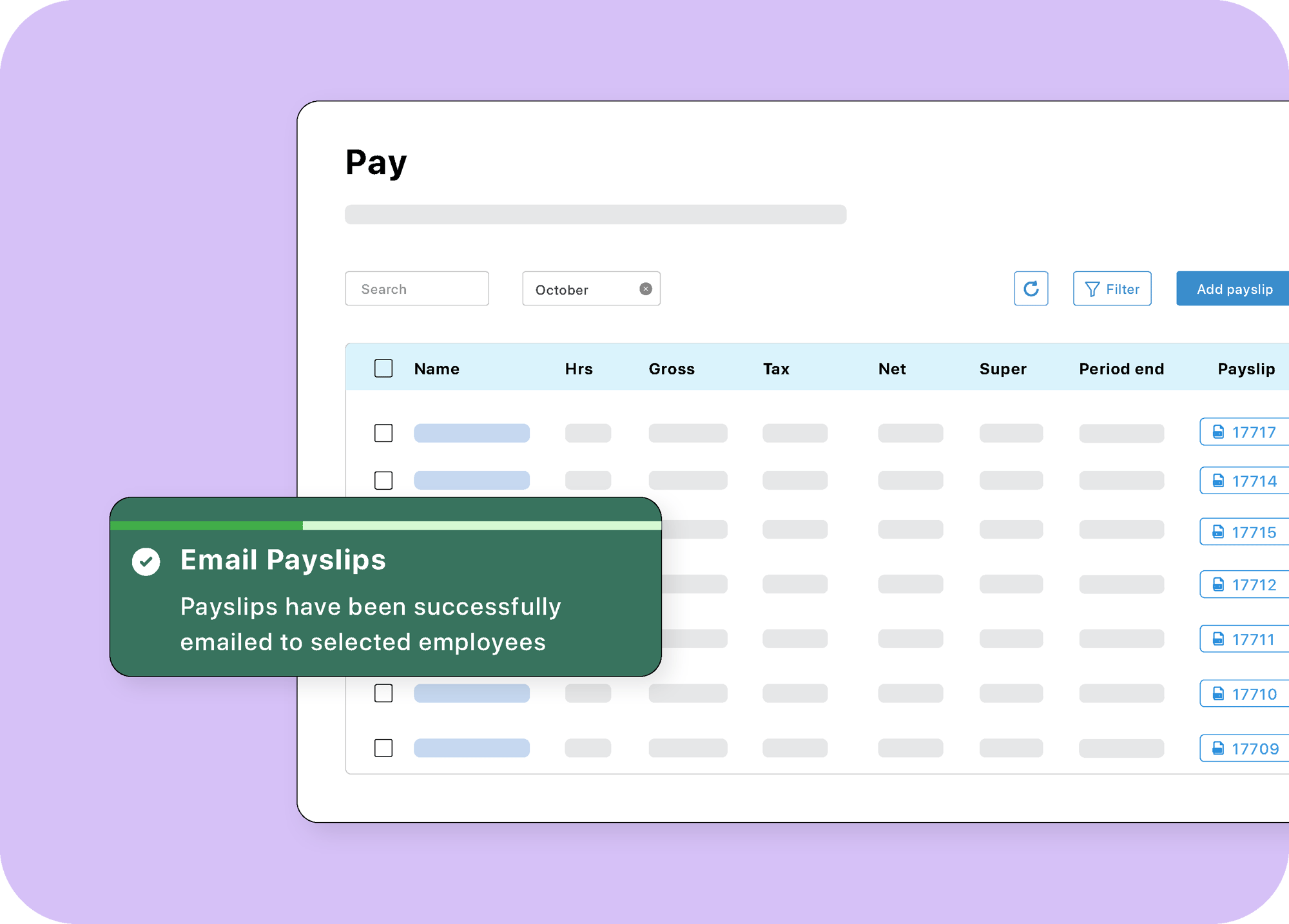

Keep your cash flow healthy

Access the money you've already earned, so you can easily pay your team on time.

Fast invoice funding with APositive

Invoice, fund, and pay in a few easy clicks and boost your cash flow confidence.

Invoice, finance, and pay in a few clicks

Using the seamless integration between foundU and APositive, you can gain automatic approval and access up to 90% of the funds tied up in your unpaid invoices. Use the funds immediately to pay your team, take on new work, or invest in the growth of your business.

Smooth out your cash flow

It can be stressful waiting for invoice payments when you need to pay your team on time. It's hard to negotiate favourable payment terms and build your cash buffer when you're getting started or scaling up. We've sped up invoice funding so you can keep your business humming and achieve more, without having to worry about customer payment cycles.

Grow faster

We've simplified access to funding so you can have cash flow confidence, especially when you're trying to win a big contract or take on a new customer. Explore growth opportunities you might not have considered before because you were held back by cash flow hurdles.

"We’ve experienced big wins and weathered economic storms using APositive’s smart invoice funding and foundU’s brilliant tech. No matter what’s happening in the market, we know our payroll is covered and our cash flow is strong."

%20copy.png?width=150&height=64&name=thumbnail_Volley%20Recruit%20-%20Logo_Gradient_On%20Light%20(1)%20copy.png)

Frequently asked questions

What is invoice funding?

Invoice funding (also known as invoice financing) helps you access funds based on the value of your outstanding invoices. It allows you to secure invoices earlier than your customer payment terms.

Do I need invoice funding?

Invoice funding is helpful for labour hire and recruitment businesses. This is because they can be subject to seasonal trends and long customer payment terms. If you're starting out or trying to grow your labour hire business, it can help you get to the next level faster. This funding model moves at your pace and gives you access to the money you've already earned. It enables you to take on bigger jobs, without worrying about how you'll pay your employees before the invoice payment comes in.

It could also give you peace of mind if you're concerned about how the new minimum wage increase or proposed Payday Super requirements could impact your cash flow.

If you're using another funding option, like a cash or business loan, then invoice financing can offer you a more secure, debt-free cash flow cycle.

What percentage of incoming invoice funds can I access?

APositive can facilitate a variety of packages that are tailored to your business with up to 90% of funds available. You can talk to the team to explore a solution.

How much does invoice funding cost?

There are multiple pricing models available to help meet your requirements. APositive can charge a single fee as a percentage of your invoice, so you know your costs and the impact on your gross margin upfront. Alternatively, they can provide a Line of Credit where you only pay for the funds you draw.

How do I get started?

Book a demo to see how our fast invoice funding solution works. We will also help you enable the integration with APositive.