Payroll software, done right Payroll software, done right

Gain more control of payroll than you’ve ever had before. Our award interpretation and pay-rule engine will help you get pay right, every time.

You’ve just found a payroll system you can count on

Australia has some of the most complex IR laws in the world and foundU is built to help you comply with them.

Pay with precision

All of your upstream workforce data will flow straight into payroll via our powerful award-interpretation and pay-rule engine.

Enjoy compliance assurance

We own and control all of our core workforce management features. That means that when legislation changes, so can we.

Gain control of payroll

Never accept inefficiency just because your payroll system is out of date. Respond to change with our adaptable single touch payroll software.

Automatically update pay slips

Our onboarding, rostering, attendance, and payroll tools are all built-in, not integrated. So, workforce data will be sent to payroll in seconds. Easily capture every single payroll event, such as employee updates, roster changes, shifts worked, and leave requests, then your pay slips will update immediately. When you’re processing pay and STP reporting, you’ll be relying on real-time updates – not manual data entry and guesswork.

Gain payroll compliance assurance

foundU is built for Australian businesses with the complexities of Australian employment law in mind. It has the flexibility to handle modern awards, enterprise bargaining agreements, National Employment Standards, and your business needs. Our powerful award interpretation and pay-rule engine automatically calculates wages, overtime, and other entitlements to help you get pay right every time.

Streamline Single Touch Payroll reporting

Automatically send all employee payroll data, including salaries, wages, PAYG withholdings, and superannuation to the ATO each pay cycle. Our seamless STP V2 compliant integration removes manual handling and provides precision. Unlike most payroll software providers in Australia, we built our own Single Touch Payroll reporting technology, which means it can be easily updated no matter what the ATO throws at us.

Simplify super payments

Easily accrue, track, and report your superannuation liabilities in detail. Supported by our integration partner, Beam, we can also help you make swift and secure super payments, ensuring employees receive their benefits quickly. Our seamless superannuation payment technology will prepare you to meet the upcoming Payday Super requirements, commencing July 1, 2026.

Automate leave management

Receive all leave applications via a central portal. Your leave requests will all stream into one menu so you can approve, decline, or edit requests in a matter of clicks. Employees get live notifications via their app and the data will automatically flow through to payroll for processing during the relevant pay period. You can also get a clear view of who is on leave via our time-off calendar or export leave to your work calendar.

Scale up your business

Our payroll software can scale up and grow as you do. Adding new operations, sites, entities, and locations is easy. You can simply duplicate your existing workflows and then configure them for each new area of your business. When you get more visibility over your entire payroll function via one central system, you’ll be able to free up time for more strategic tasks and find efficiencies.

Single touch payroll software integrations

Wirely

Wirely helps hospitality businesses manage their revenue and cashflow. Providing real-time access to financial insights it can help you unlock your full potential.

APositive

APositive helps recruitment, labour hire, and contingent workforce businesses overcome cash flow and administrative hurdles, so they can start and scale their business.

Evisory

Grow smarter, stronger, and safer by harnessing the power of technology. Evisory helps businesses thrive with accounting advice that’s empowered by technology.

Pay your team with one powerful system

Frequently asked questions

What is payroll software?

Payroll software automates the payment of employees. It helps payroll teams with pay calculations, tax filing, superannuation payments, and reporting.

What is single touch payroll (STP)?

Single touch payroll (STP) is an initiative led by the Australian Government, which streamlines how employers report to government agencies. When payroll software is STP enabled, it reports payroll information such as salaries and wages, pay as you go (PAYG) withholding, and superannuation liability information to the Australian Tax Office.

Why is payroll software important?

It’s important to pay your employees right and compliance breaches can be costly. Payroll software reduces manual handling and human error, so that you can pay your people with precision while staying compliant with Fair Work regulations. Payroll has to be completed many times throughout the year and automating the process can save your team a lot of time, allowing them to focus on more strategic tasks. Payroll software can also help you track your wage costs, helping you find opportunities for growth.

Can employees be assigned multiple positions in your payroll system?

Yes. We’re one of the only payroll systems in Australia that can automatically calculate the right pay rate for employees who work multiple positions across varying awards and agreements within the same pay period.

Can you calculate leave accrual balances for future leave requests?

Yes, all leave requests display the estimated accruals for the time that the leave will be taken. This ensures that your employees can submit future leave requests with complete visibility and helps your payroll team understand the businesses leave liability.

Can you configure different pay rules for varied positions?

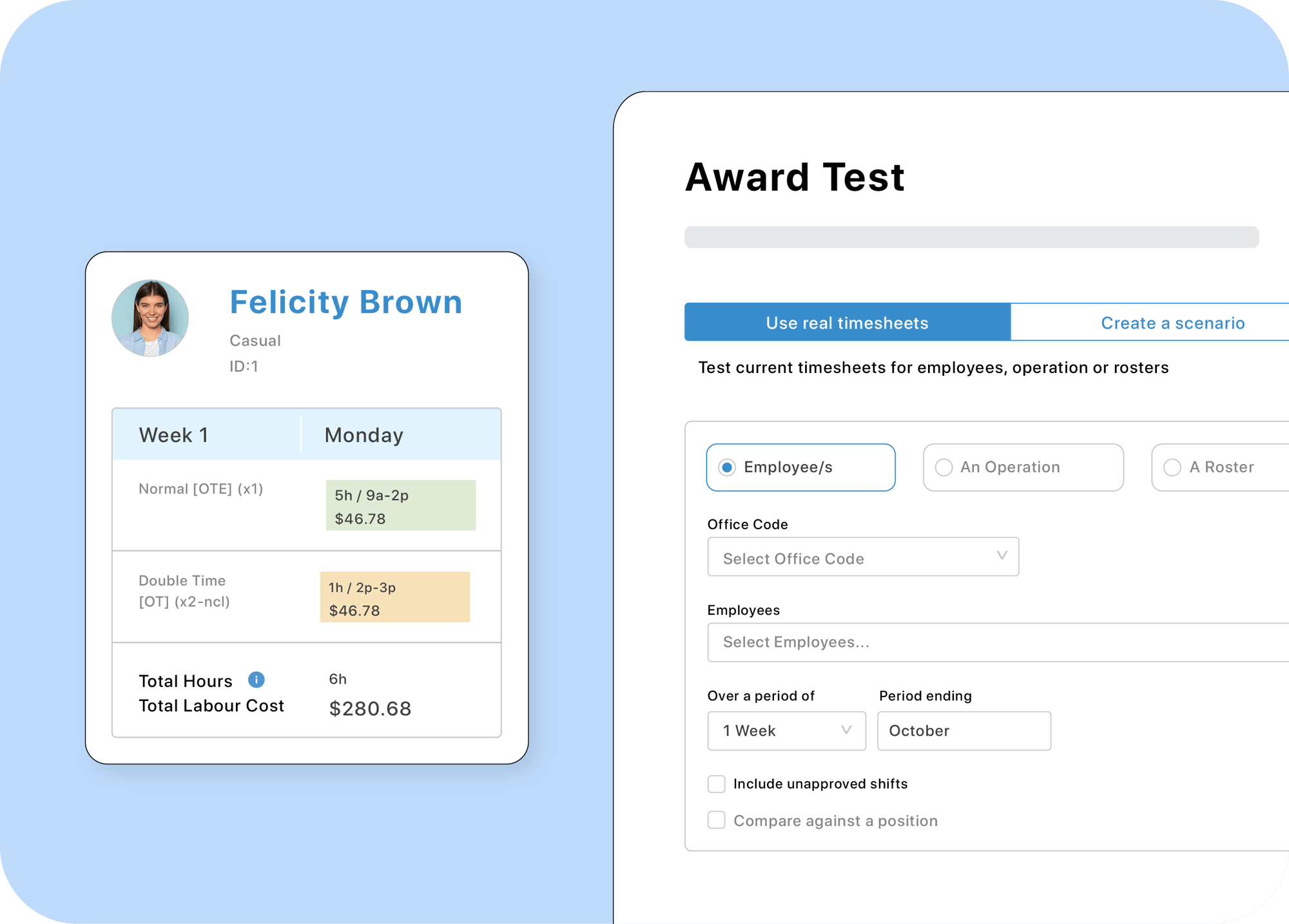

Yes, our powerful award interpretation engine can be configured to suit your business needs. Our intuitive design allows you to update your award settings and test your pay runs to ensure you are compliant.

"We looked at a range of companies during the scoping phase, but these were only rostering solutions and still needed to be integrated with a payroll system. foundU was the only end-to-end platform that we identified that could meet the payroll requirements we had. If your business is looking for an easy onboarding system, a well-managed rostering system, and an efficient payroll system, choose foundU.”

- Angela Scerri, Payroll Manager at Harmony Early Education

Popular features that complement our payroll software

Time and Attendance

The actual time worked by your employees can be captured by our clock app, geo-location check in, QR codes, or in-app shift submissions. This operational data automatically flows into payroll so that you can approve shifts and pay fast.

Employee App

Your employees can keep their payroll information, availability, leave, time and attendance, and qualifications up-to-date via their employee app. Be confident that you’re getting pay right with current position, hours, and leave data.

End of Financial Year

We’ve automated payroll to take your EOFY headaches away. Since you’re capturing the data you need throughout the year, you’ll reconcile and hit your deadlines with ease. We can also apply your minimum wage increases in the platform.

.png?width=180&height=180&name=EVISORY%20LOGO%20(2).png)