How to Streamline Your Payroll Process

Contents

Ready to simplify, scale, and grow?

Subscribe to get the latest workforce management and payroll news in your inbox.

Streamlining payroll isn't just about pushing fewer buttons faster. It’s about reducing errors and complex compliance monitoring procedures that can quickly consume the payroll team's time.

When your payroll process is manual, fragmented, or disconnected, you create room for error and extra work. However, when you have a connected system, including real-time workforce data, connected workflows, and precise pay rules, you can trust your calculations and pay your team with more pace.

Let’s explore the best ways you can speed up payroll and make it more efficient.

1. Consolidate into one unified system

If you have multiple tools and they don’t “talk” to each other, you may get data inconsistencies. Look for a complete workforce management and payroll platform that combines employee onboarding, rostering, time and attendance, and payroll. This will help to eliminate the need for multiple systems and manual data transfers. It will streamline the entire process and reduce errors made from double-handling.

2. Automated calculations

Your payroll software should automatically apply pay rules, allowances, penalties, and overtime based on award interpretation. This helps you pay staff across multiple awards and locations at scale.

3. Help your employees self-serve

Using an employee app, staff can update their own details, for example, tax file number and availability, upload documents, and check pay slips, reducing the administrative burden on your payroll team.

4. Implement dashboards and reporting

Real-time dashboards that show important payroll items like approved shifts and variances will make it easy for your team to spot and resolve issues before payroll is processed.

5. Distribute pay slips early

In some instances, you might want to let employees review draft pay slips before payday, allowing errors to be caught and corrected early, reducing last-minute adjustments. Sending them before pay happens gives your team a chance to fix errors before they’re made, reducing time spent on correcting issues.

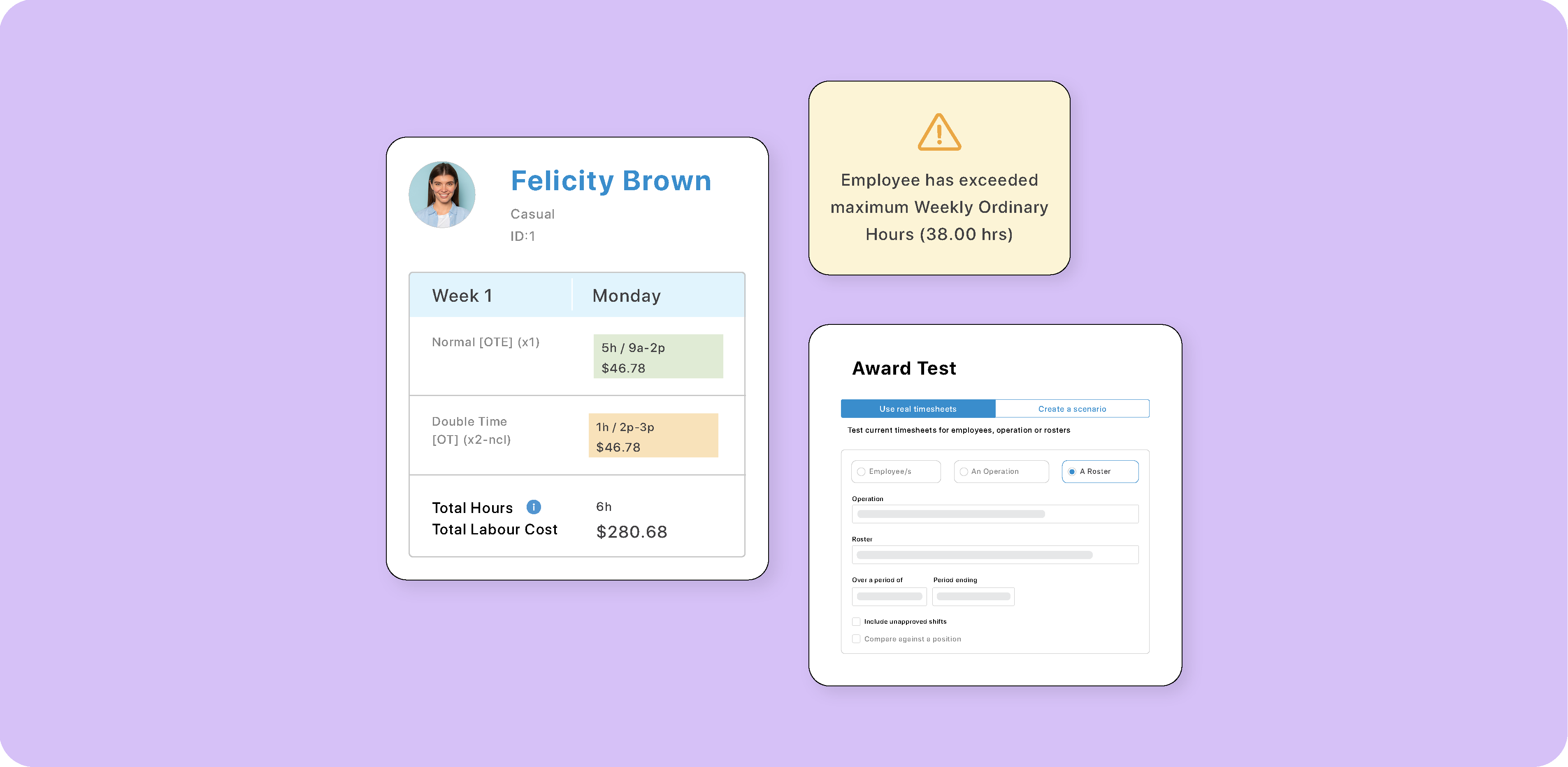

6. Use an award test tool

An award test tool will help you see how shifts will be paid, including overtime triggers and penalties. This allows you to understand how pay rules are being applied, letting you see what’s getting paid before a shift reaches the approved stage.

7. Automate compliance

Set up notifications and reminders for expiring documents, required actions, and payroll compliance tasks. This will help ensure that your compliance information is always up to date, preventing you from having to make large updates down the track.

8. Set up pay rules and error-proof your system

Use a payroll system that can handle complex and variable award conditions.

Set up your pay-rule engine so that overtime, shift allowances, leave accruals, and multi-position rates are automatically calculated. Regularly test scenarios (for example, an employee with multiple awards, or someone taking leave across pay cycles) to ensure the engine can handle edge cases.

9. Implement audit trails and versioning

Track changes to pay slips with a version history for transparency and audit purposes. Can you see what a pay slip looked like on day one of your pay cycle, all the way through to the final day? How quickly can you identify changes that have been made?

10. Use workforce management and payroll reports

Ensure that your payroll software enables you to create helpful reports and export data so you can quickly check for variances or issues. This will help you save time on reconciliations and audits.

11. Guided implementation and training

Access onboarding support, training sessions, and ongoing help from your payroll provider to ensure team members are confident in processing payroll. People are just as important as the tech when it comes to speeding up payroll.

12. Look for scale and visibility

As your business grows, adding new sites, entities, and staff, your payroll system should scale without creating chaos. Look for a platform that can add on new sites easily, duplicating existing workflows while being able to configure pay rules for each new entity.

13. Implement payroll variance reporting

Use payroll variance reporting to identify payroll discrepancies. Compare hours and earnings across different time periods to spot errors, anomalies, and trends. This style of reporting will help you compare scheduled versus approved hours and costs. Compare it to pay slips and award testing tools if you want to investigate variances across pay periods further, helping your team easily control labour costs and manage compliance.

Simplify, scale, and grow

If you’re constantly spending time on manual interventions in payroll, or your systems don’t talk to each other, now is the time to review your payroll workflows. Select a platform that brings together onboarding, rostering, time and attendance, leave, and payroll, so you can focus on scaling up your workforce and growing your business.

If you want to explore how foundU’s combined workforce management and payroll platform can streamline your payroll, then book a demo to speak to one of our product experts.

Related resources

The decision to change payroll software isn't an easy one. Payroll is an essential function in your business as it impacts your employees, pay slips, tax, and...

The end of the financial year can be a challenging time if you work in payroll. Any discrepancies in your payroll data may start surfacing as you start...

Australia has plenty of public holidays scattered throughout the year. While many of us enjoy taking a day off or benefiting from additional entitlements, public...